Make a good rental investment: 3 essential criteria

Engaging in a rental investment is not without a choice repercussion. This choice may turn out to be good or bad depending on some criteria. Sutton Quebec invites you to discover 3 main pillars for a successful rental investment: buy a home that can be rented easily, that will be profitable and that will easily be resold.

The ease of renting your rental purchase

The first step is to find the right property to buy to rent. Remember that a rental investment is not for the purpose of living there yourself. The purchase criteria for renting are therefore different. It will be necessary to study this purchase according to the demand and the crippling criteria of the lambda tenant. There are indeed more requested criteria and you will naturally turn to them.

The environment and area ratio

A rental investment should not be chosen too far out of the way. There are three main types of sectors to choose from in order to invest well:

- the center of the city

- nearby neighborhoods that are well served

- more of residential and family sectors

So naturally comes the link between the environment and the area to be chosen:

- If you are in the heart of a dynamic district with shops at proximity, bars and restaurants, opt for a rental purchase of small area to target students or young workers.

- If you are in a residential area with schools and public transport nearby, aim for a larger area to accommodate a family. The price can also be more interesting.

Your Sutton Quebec real estate broker will be able to provide you with all the advice relating to a rental investment: the most popular sectors, the most popular rentals, surfaces, rents, etc.

The occupancy rate

To be successful in your rental investment, you must study the rental market: supply and demand. For this, an indicator will be very useful: the occupancy rate. If the rate is high, there is sufficient demand to supply. However, the opposite is not a good sign. Choose a location where the occupancy rate is high. It will indeed take less time to find a new tenant.

The profitability of your rental

If you are embarking on real estate investing, don't lose your main goal: profitability. Earning money with a rental apartment is a long term goal. One piece of advice: take your calculators!

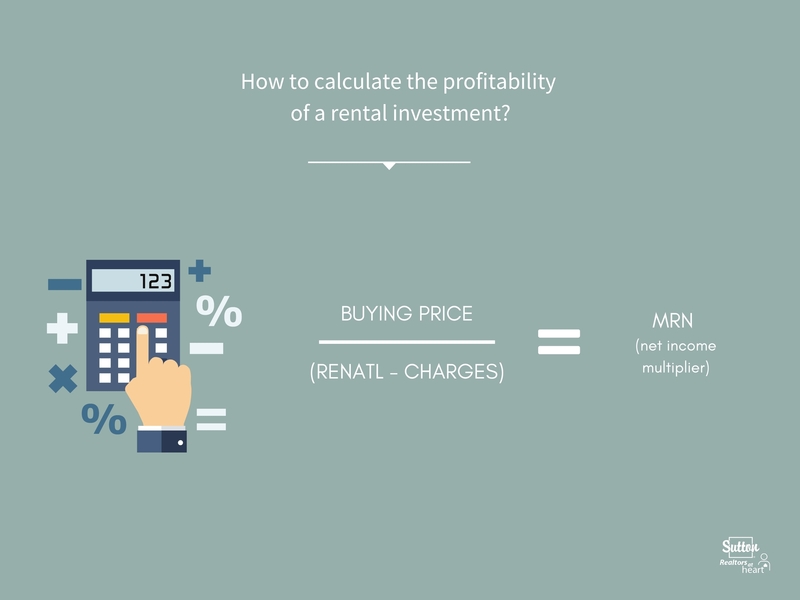

How to calculate the profitability of a rental?

There are two types of indicators:

- the MRB: gross income multiplier

- the MRN: net income multiplier

The MRN should be favored because it will be a more accurate indicator for your finances. It takes into account the costs related to the rental such as charges, insurance, taxes or even your rental management costs. A good profitability ratio will be between 10 and 16.

Calculation example:

|

Purchase price |

$ 100 000 |

|

Gross income (rent) |

$ 8 000 |

|

Fee |

$ 1 000 |

|

Net income |

$ 7 000 |

The ratio will be 100,000 / 7,000 = 14.

This ratio is actually the number of years it will take you to reach the 0 threshold. This way, you will start making money on top of your initial investment from the 15th year.

The mortgage

Pay attention to the monthly payment of your mortgage and the rate so that the sum to be repaid does not exceed the rent received.

Generally, banks will carry out a stress test or bank resistance. This simulation allows you to assess your ability to repay your debt in a worst-case scenario.

The ideal is an investment that releases a little bit of liquidity or cash flow every month.

To find out more, find our article: Relevant ratios for your real estate projects

The added value of your rental investment

When you buy to rent, you must immediately think about resale. The goal is not to lose money if you decide to sell a few years later. Hence the importance of choosing the right neighborhood. Before reselling your rental property, repair it to be able to make a better capital gain. On the other hand, it will be necessary to take into account the tax related to this gain.

Indeed, a rental investment is not your main residence. If you resell your acquisition, you will pay a capital gain tax.

50% of the amount of the capital gain will be taken into account for the calculation.

If you realize a capital gain of $ 50,000, the calculation will be based on $ 25,000. Also come in deduction:

- expenses such as carrying out work

- brokerage fees

- amortization

The tax rate varies between a corporation and an individual. Check with your real estate broker to make a simulation.

You now know the 3 pillars to make a good rental investment. Contact your Sutton real estate broker to begin your research. These 3 criteria are sources of success, but the rest should not be neglected… find a good tenant and manage their rental properly. Discover our article: Calling on a rental property manager?